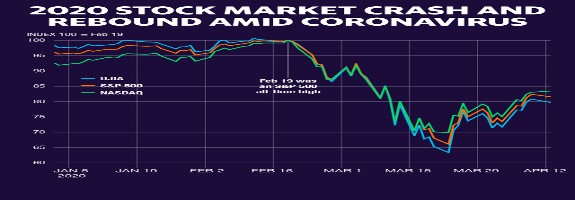

Back on April 1st, shortly after the stock market meltdown, as investors bailed on solid companies and good stocks were being sold for ten cents on the dollar from where they had been, you may recall I wrote that people should not cash out their 401Ks. I also gave my opinion that then was the time to actually invest.

Found in my April 1st post, I shared a story from when I was young and stupid and panicked during a market crash. Never again.

In this past crash, I actually recommended buying stocks that had cash reserves, or could expect government help with bailouts. Where others only saw panic, I saw opportunity.

I wrote that I would be investing in Real Estate Investment Trusts (REITs). At the time, I had already purchased cautiously, but by April 1st, I was bullish on REITs, and eventually went all in.

How am I doing so far, not having a degree in economics, but only past experience as a guide? It turns out the old adage, “Even a blind squirrel can occasionally find a nut,” is true. If you were actually dumb enough to take my advice, you should be doing well at this point.

There were some dogs among the dozens of REITs I researched during the first week of April, but there were also good ones that were pulled down in the market crash. Almost every one of them cut their quarterly dividend anywhere from 50 percent to 100 percent, as they sought to reduce the leverage they had imposed on themselves, and retain cash to fend off calls for immediate repayment of loans from investment firms.

The years of an REIT selling for more than $20/share and paying a 20+% dividend yield came to a screeching halt. Those that had sold for under $10 before the crash, could be picked up for less than $1 in a few cases.

Sure, the large dividend yield was gone, but so were the high prices and if they survived, which they were doing by selling off assets and paying off debt, a panicked $2 share price might not reach $20 again for a decade, but would $5, $7, or $10 be achievable in a year or two?

As a bonus, an REIT must distribute 90 percent of its profit to shareholders if it wants to maintain huge tax exemptions, which meant as they recovered, the newly imposed 0-5% dividend yields would increase.

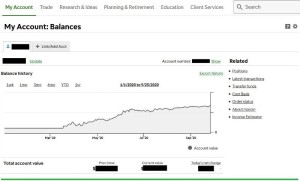

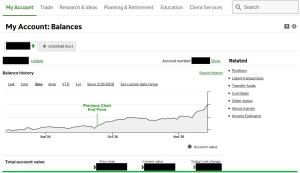

I had a decent amount of cash in an Ameritrade account. It sat there for more than 20 years, doing little more than taunting me to buy stocks with it, but I never pulled the trigger. I always remembered that pain of the 1987 crash and missed the opportunity that came in 2008, still too afraid of losing my nest egg.

I kept it as an “untouchable” savings account, since it was in my ROTH IRA. I figured I would withdraw it when I retired. However, when the pandemic crash came, I realized it might be my last opportunity to see a major market crash and take advantage of it.

So far, my REITs have not only recovered from their lows, but I’m now getting dividend yields larger than those reported at their current market price, following their recent increases. You don’t get returns like that from any bank or CD.

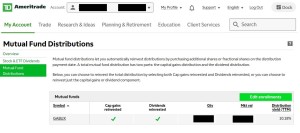

To hedge my bet, I sold one of my stocks that did nicely in price and put it all in a utilities mutual fund, figuring even if the country goes into another Great Depression, it’s always the utilities that get paid and survive. Everyone wants their lights on.

What will the next 6 months bring? Is it too late to invest in the stock market?

I’m not giving any advice this time around, because I’m not confident of what I think is coming next, though I do have my eye on a renewable energy stock that looks promising and safe.

It was fairly easy to find some gems when the market bottomed out, but I’m unsure of what’s coming with the pandemic, the rushed vaccine, and a very real possibility of a President that will refuse to leave office, if defeated.

However, if you think you’re interested in buying stocks, I don’t recommend Ameritrade as a brokerage house, considering they require a minimum of $10,000 to maintain a margin account, though they do offer a ROTH IRA that only requires a small contribution to get started.

Updated 11/13/20 to add new stock chart. Gains are the result of an unbelievable rally due to the anticipated and final election results, along with a vaccine announcement from Pfizer.

Notice: Any and all discussion of a stock or investing should not be considered financial advice and is for entertainment purposes only. I often lose my car keys and forget where I parked my car. I am not a financial advisor. Do your own analysis before investing.