Many professional stock analysts are becoming increasingly worried the stock market is on the verge of a major correction downward.

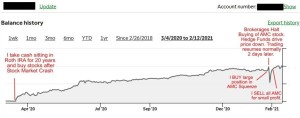

The analyst I follow, with a paid subscription to his service and advice on individual stocks, thinks so. Considering the young man has been right 95% of the time, I’m following his advice to greatly reduce my positions in growth stocks (hardest hit in a crash), pull back in value stocks (slower growth, but hurt less in a crash), and increase my war chest of cash on hand in my Roth IRA, to take advantage of a possible crash.

He makes note of the exuberance of investors and the fact that it has reached the height that preceded the last two stock market corrections (unrelated to the pandemic crash).

Last month, the global stock market cap surpassed 120% of global GDP, and thus above the percentage seen before the crash in 2008.

A majority of stocks are far overvalued, as retail investors keep pumping money into them, based on predicted earnings 3-5 years in the future. In “normal” times, stocks were valued for their potential only 6-18 months down the road. The pump of new cash is driving prices up, far ahead of true value.

I’m not a stock analyst, but even I know the DOW is not a reflection of how well the economy is doing. The number we see, having set a new high recently when it closed 10 points shy of 31,500, is based on only 30 companies. New retail investors, mostly in the 21-39 y/o age group, are pouring money into the market, buying on speculation and momentum, rather than fundamentals.

Using Tesla as an example, its P/E is 1280x. Meaning, the price of Tesla stock is 1,200 times greater than what it is earning in profit, but investors continue buying, gambling they can sell it for more to the next fool.

Our economy is not doing well, especially hit hard during this pandemic, in which the last President wasted almost a year by ignoring it, or lying about it.

Unemployment is up, with the percentage of unemployed almost double what it was before the pandemic. Small businesses were lost, with many barely hanging on at the moment. People are working part-time jobs to stay afloat, while some who could never keep a job in better times, will continue to head for that shopping cart in their future.

The only thing that seems to be keeping the market up has been stimulus money from the federal government, industry bailouts, the allowance of delaying bills, and new retail investors diverting money not payed toward bills, into the stock market.

There is still much debate on how that first round of stimulus money was used. While many who were in need used it to pay down credit card debt (CC debt actually went down last year) and catch up on bills, others who still retained their jobs working at home, invested in the stock market, or started home projects (Home Depot and Lowe’s stocks hit new highs).

People also took advantage of the ability to have their mortgage payments and utility bills delayed, putting that money into the stock market and home repairs, even when they weren’t in financial trouble.

Inflation has yet to rear its ugly head, but is expected. Though we may not see a repeat of the 1970s, when inflation hit double digits in 1974, it is unlikely it will remain at ~2.5%, where it currently stands.

The stock market dropped more than 50% from 1973 to 1983 due to inflation, and a number of other factors. It wouldn’t be until 1992 for the stock market to break through the previous level of 1973, as retail investors wanted little to do with stocks after suffering losses. It wasn’t until the “dot com” speculator frenzy began when the market started to take off again, followed by another downturn when that bubble burst.

When a government borrows in its own currency (eg. U.S. government borrowing in USD), higher inflation will tend to devalue the local currency and as a result, the amount owed. An increase in debt leads to a greater supply of money in the economy which can sometimes be a precursor to rising inflation.

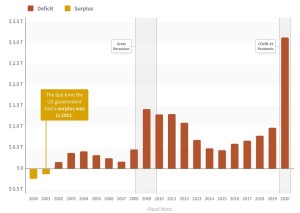

The National Debt Clock is now approaching $28 Trillion. The NDC adds gross federal debt and debt held by the public, plus debt held by federal trust funds and other government accounts.

Those are the factors that can affect the stock market, once the repercussions hit the populace and major businesses still operating.

Getting back to the stock market today, the general consensus of market analysts is that another bubble is about to burst. This one is a broader, more encompassing bubble of the entire market, concentrated in stocks that have risen without the fundamentals of earnings reports that support their growth.

It’s based on speculation too far out for most to be accurate, but when the speculative and growth stocks break hard, it will pull properly valued stocks down with them in a broad market decline, as everyone tries to sell positions and retain cash.

Another trend being noticed is private companies going public, hoping to take advantage of that speculation. Especially tech and renewable energy companies.

Initial Public Offerings (IPOs) set a new record in 2020, with 480 companies going public. 2021 is keeping pace, so far. Owners are hoping to cash in on the speculation.

As an example, Bumble, a company that has a dating app by the same name, had its Initial Public Offering (IPO) on Thursday. It made less money in 2020, than it had in 2019.

Few IPOs actually end their IPO day at less than the opening price, and at their initial announcement of between $30 and $32 per share at the opening, Bumble wouldn’t be unreasonably priced. Not unreasonable, if Bumble could get back to its previous profit level of 2019, after the pandemic is over. It would be valued at ~$6 Billion.

Two days before the IPO, the underwriters of the IPO announced the opening share price would be $43 due to the interest shown, creating a value of ~$8 Billion.

Bumble ended the day over $70.

That’s a market value of $14 Billion on a company that had a net loss of $81 Million in the first 9 months of 2020. Bumble’s owner became a billionaire in one day, rather than a multi-millionaire.

Considering the Bumble app derives most of its revenue from ads on its unpaid version (or paying $20/mo. for ad removal), the requirement of only fully clothed profile pics (no bathing suits), and the fact that only women can swipe left or right (men can not make first contact), buyers of Bumble would be better off investing in a Christian dating app., unless it becomes the favorite app of 100 million lesbians paying $20/mo.

Yes, Bumble would need to add about 100 million paid subscribers to remotely justify the current stock price. Considering the well-established competition like Tinder and Match.com, that isn’t likely.

When dumb money invests in hype and overvalued stocks, yeah, I’m believing that a market correction is coming, and people may see more than a 25% haircut on their portfolios.

I pulled back my stock positions on Friday. With only a few exceptions, those that I didn’t close out entirely, I reduced my exposure. I’m going sit on the sidelines for awhile and see what the next four weeks brings. With stocks over-extended as they are, it is becoming increasingly difficult to find something that hasn’t become far over-valued and extremely risky.

Notice: Any and all discussion of a stock or investing should not be considered financial advice and is for entertainment purposes only. I often lose my car keys and forget where I parked my car. I am not a financial advisor. Do your own analysis before investing.

Disclaimer: On January 4, 2016, the owner of WestEastonPA.com began serving on the West Easton Council following an election. Postings and all content found on this website are the opinions of Matthew A. Dees and may not necessarily represent the opinion of the governing body for The Borough of West Easton.