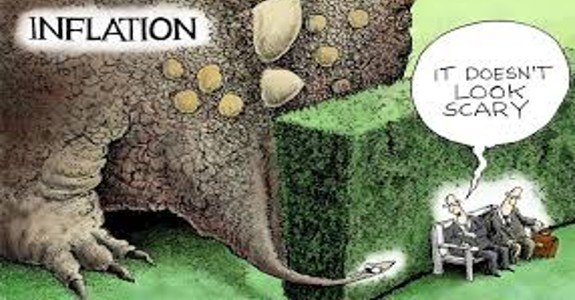

If you’ve fueled up your car and gone shopping, you’re wondering how the government has come up with the number of only 6.8 percent inflation. You can see it’s costing you far more than that, when purchasing the same things you bought last year.

Gas is up a dollar per gallon. Ground meat is up more than a dollar per pound, and buying a steak is now a luxury expense. Even the Dollar Store has announced that they will be increasing the cost of items from $1 to $1.25. That’s a 25 percent increase on merchandise. It’s obvious our own fiat currency has less buying power, due to inflation.

The reason we’re confused about the obvious discrepancy in what we see, compared to the official government number is: CPI inflation is being systematically undercounted.

The practice of undercounting isn’t new. It’s been done for decades under administrations of both political parties, and the vast majority of American consumers don’t understand how the official government number of CPI inflation is calculated. Admittedly, I was just as ignorant about it, until I was determined to understand it.

It’s suppressed in such a way that the bureaucrats are able to gaslight us into an inflation narrative that suits them, and in January of next year the agency tasked with calculating this metric is making some changes that could further pull the wool over our eyes.

This is a fairly long post, but it needs to be, if you want to get an understanding of how the CPI inflation number is derived, and come to the realization that you aren’t crazy in believing inflation is higher than we’re being led to believe.

You need to know about the CPI magic trick, and what it could mean for your wallet.

CPI is the acronym for, Consumer Price Index. It’s a measure that examines the weighted average cost of a basket of goods and services over a period of time that could be monthly, quarterly, or yearly. The changes in the price of this weighted basket of goods and services is then used in order to determine the CPI Inflation Rate. In other words this is generally used as a benchmark for the average change in the cost of living that consumers face.

So, what’s in this basket?

It’s composed of over 80,000 different goods and services, but they’re broadly broken down into eight major groups.

In order to give the most representative breakdown of the consumer basket it takes a look at those consumers who live in urban environments. That is, those that live in large cities.

The agency that’s in charge of formulating and calculating this CPI measure is the Bureau of Labor Statistics (BLS). It’s been doing this since as far back as 1913, so it’s a metric that’s been used for over 100 years, but it’s important to point out just how much power this agency has when it comes to measuring that CPI.

It determines everything from the types of goods and services that are included, to how that changes over the years, to how that is all calculated.

The BLS conducts surveys amongst urban consumers in order to get an idea of what should be included in that basket of goods and services. Then, every month it tracks the prices generally, by asking businesses what prices they’re charging, in separate surveys.

Though they have recently started to collect information from online outlets, that data is still limited, even though online purchases have reached all-time highs.

The BLS calculates the change of the price in the basket every month, and reports it as two numbers. One is the Headline CPI number and another, which is called the Core Component number.

The Core Number is the CPI that strips down the impact of so-called “volatile items,” such as energy, or housing. The rationale here is that these numbers are easily impacted by outside factors (such as the OPEC oil crisis in the 1970s) and should not be focused on as a metric for policy making.

That sounds like an easy out for the government pencil pushers to keep the CPI low, but we’ll look at that more closely, as we get further along.

To say that the CPI measure is important, is an understatement. In fact, irrespective of actual inflation this single published number has a sizable impact not just on the economy, but your personal circumstances. The first and most important impact that the CPI has on your daily life is what it means for your paycheck.

In most conventional jobs your employer will determine the yearly increase in your salary based on a number of factors. Of course, you should have a salary increase based on promotions, or performance, etc., but the company-wide pay increase for all employees is generally weighted, based on the general increase in cost of living (inflation). They often place a lot of emphasis on what the CPI Inflation Rate is determined to be.

There are also numerous financial products that are issued by mutual funds, which reflects CPI inflation. Banks and other financial services companies, which are tied to inflation payments, are determined based on the official inflation numbers.

It goes without saying that the government itself places a lot of emphasis on these official inflation numbers. For example, they are used to determine exactly how much Social Security, or other government support programs pay out. The more the cost of living, the higher these payouts have to go. Realize, there are hundreds of social programs which are affected by the CPI.

You have tax brackets affected. The IRS uses the CPI measure to determine where the tax brackets should go. If people are earning more because of the increase in cost of living is resulting in higher wages, then the tax brackets may be moved up to reflect this, as well.

You also have numerous financial instruments that are tied to the CPI Inflation Report. For example, the government issues what are called TIPS, or Treasury Inflation-Protected Securities. They pay investors out a real yield that takes into account the inflation in the country.

There are also other very important government statistics that rely on these measures. The Bureau of Economic Analysis (BEA) produces real GDP growth figures. To get the best measure of real GDP growth it needs to strip out inflation as best it can. The lower the inflation, the greater the GDP growth number that can be reported.

Moving beyond government statistics and services, one has to think about moves by central banks. They track these inflation stats closely because they impact on their monetary policies. It helps them determine whether they should increase or decrease the speed of their money printing machines.

What Jerome Powell and his buddies at the Fed decide to do with their money printing machine has severe implications for everything in the economy – including inflation. They can also see what effects their own policies are having on inflation. If it’s a bad reading, it could result in a response that makes things worse, in trying to correct it. Deflation could result, but that’s a different beast I won’t go into.

Speaking of CPI measures actually causing inflation, you have the impact of inflation expectations more broadly. If businesses expect higher inflation they raise their prices preemptively, so a higher CPI has the perverse impact of actually increasing inflation itself.

It’s pretty safe to say that the CPI inflation number is a massively important number and is likely the more important government reported numbers out there, mainly because of where, and how, it is used.

Is the CPI measure being systematically under reported, compared to actual inflation? I believe it is.

As I did, you’re about to learn how it is manipulated lower, because we’re going to dive into some CPI accounting.

The most important thing to know is that the CPI measure does not track the price of a static basket of goods and services. Rather, it tracks price changes in a basket of goods that itself changes in composition.

Until the 1980s there was a constant basket of goods that was tracked. However, it was decided that a change in that methodology was required. The BLS decided that this basket of goods would be updated, to try and reflect consumer preferences. This is now updated every two years, based on consumer surveys that the BLS conducts, but there are a number of other rules of thumb the BLS uses, which are quite questionable.

You have the fact that the BLS takes into account substitution of items previously found in the basket. Put in simple terms, the more expensive things become the more likely people are to substitute those goods with something else, because it’s cheaper. If beef is too expensive they’ll eat chicken – so the BLS will change the basket to reflect that.

Back when the BLS changed the methodology it took the view that the basket should reflect a constant standard of satisfaction, and not a constant standard of living.

Think about that. It’s systematically under counting how expensive things have become, because it assumes people will move to cheaper items. This isn’t entirely untrue, but is it an honest reflection of inflation?

It’s only logical that people will tend to substitute. For example people are buying more chicken, because beef costs too damn much these days. But is it fair to tell us, we who used to enjoy a thick, juicy steak on the grill, that actually prices are not going up that much, because we just stopped buying the things we can’t afford?

Then, on top of the actual composition of what is inside the basket you have the “relative weight” of goods and services it contains.

The BLS introduced what is termed, “geometric weighting.”

Basically, that’s a mathematical stunt that will reduce the weighting in the calculations of those goods that are increasing in price. So, without much survey data, the BLS is applying an arbitrary adjustment that automatically moves the basket value away from those goods that are increasing in price.

The basket is very deceptive, to say the least.

The CPI measure also doesn’t take into account the shrinkage of products in packaging. For example, a half gallon of ice cream (2 quarts) that has been reduced to 1.75 quarts, or a box of cereal that is reduced by 2 or 3 ounces, but remains the same price, isn’t calculated into inflationary numbers, as a more expensive item.

Now that you know what’s in the basket and its relative impact on the reported inflation number, let’s look at another BLS adjustment that tries to account for what it terms, “quality improvements.”

Those goods, or services, that have increased in price due to easily verifiable improvements in quality should reflect that change, is the base argument of the BLS. This would make sense if, for example, a food item that used to weigh a certain amount increases in terms of quality, then it makes sense to isolate the price increase, as related to the quality of the item.

The only problem is that the BLS expanded this definition to include what they termed, “Hedonic Charges.” They alter the price of the goods and services based on certain arbitrary quality changes that were not noticeable, nor relevant to the consumer.

These price alterations are actually done with computer modeling, and as such, can be prone to error.

A simple example would be electronics. Think about how much the costs of certain electronic items have gone up over the past year. Consider the global computer chip shortage you may have heard about. You desperately need a new computer to do your work, but the prices are considerably up from last year.

You don’t really care too much about how powerful a computer chip is. All you care about is the fact that buying a PC this year costs a lot more than it did last year. The prices of new PCs and laptops are inflated.

However, because the chip is a “quality” improvement, the BLS will discount the impact of these price increases.

There are more factors in the CPI calculation that make it suspect.

One of the more unrealistic approaches to the CPI calculation is how it measures the cost of housing. Specifically it doesn’t directly measure the price of property, but more the cost of rentals.

In cases where the people own the house where they live, it tries to account for this rent value through something called, “Owner Equivalent Rent.” It’s an estimate of how much the owners would have to pay, if they were renting their house.

So, how do they calculate this rent measure?

They look at how much it would cost to rent a house of a similar size, location, and quality. However, this could result in some massive discrepancy. Rental rates don’t react immediately. There’s usually a lagging indicator.

People who have faced the explosion in the price of buying a home are not reflected in this measure. All those skyrocketing lumber costs that caused the massive increase in home prices are not being directly counted in the CPI measure. The cost of building the same average home this year was reported to be $36,000 more than the previous year, due to lumber costs.

Existing homes have increased in price by double digit percentages but, according to the CPI measure, shelter costs only increased 3.8 percent. This number becomes even more stark when you look at particular urban regions – The exact regions the CPI is meant to track.

In South Florida shelter cost is up 35 percent. In Seattle it’s up 32 percent. In New York it’s up 30 percent. These numbers just don’t square up with the stats published by the BLS.

Realize that the consumer basket, of those who are likely to be severely impacted by inflation, is not reflected in the average.

For example, poor people will be spending a larger proportion of their basket on food than your average income citizen. Those living in rural areas are likely to use cars and thus, fuel, more than those who live in the large cities. These items are only two, which have accelerated at the fastest pace over the last year, but are given less weight in CPI calculations.

Hopefully, you now not only have a good idea of how CPI inflation is being systematically under counted, but why is it so important to know you are correct in believing inflation is much higher than the 6.8 percent report recently released.

Even if you had no idea what the CPI inflation rate was you would have known that prices were increasing all around you. It’s something you can feel on a personal level. Despite how skewed the CPI measure can be, it still cannot hide the fact that prices have increased rapidly.

That 6.8 percent in the November CPI number was the highest in almost 40 years. Policymakers and central bankers had been trying to downplay the risk of inflation for months. The word, “transitory” was everyone’s favorite phrase. The immediately observable price increases everyone was seeing were only temporary, we were told.

Powell recently announced the word “transitory” will no longer be used, and now admits that inflation is a real concern. This is the reason that the Fed has reversed its stance on the bond buying program that pumped currency into the economy, and is tapering those purchases. It is also planning on raising interest rates on loans, but the damage is done.

It will be hard to get inflation under control. This is especially the case when those inflation expectations and secondary inflation effects start to work their way through the economy in the coming months.

In all likelihood, the December inflation numbers are going to be similarly high, but it’s what happens post-January, 2022, that will be most interesting. That’s when the BLS will readjust its arbitrary basket of goods. It will be interesting to see what impact the adjustment of the basket will have on the official inflation rate. Given the importance of it, it’s vital that it accurately reflects the cost of living we witness on a daily basis.

However, the evidence points to the contrary from the way that goods are substituted, quality adjustments are made, assumptions around housing, and the data collection used. The evidence points to a measure that is likely being massaged down, but won’t be able to show a decrease in inflation in the coming months.

Even with the dubious accounting methods the BLS has not been able to stave off those high and persistent inflation reports.

Hope that as we roll into the new year, the new policies will curtail inflation, and they will lead to a cooling off of the rising cost of living.

Of course, whether that cooling off is real or imagined depends on how much things change in the CPI basket next year.

Let’s just hope the BLS doesn’t make the assumption that we all gave up chicken for soy.

Disclaimer: On January 4, 2016, the owner of WestEastonPA.com began serving on the West Easton Council following an election. Postings and all content found on this website are the opinions of Matthew A. Dees and may not necessarily represent the opinion of the governing body for The Borough of West Easton.